Global Risks Report 2020 – An Unsettled World

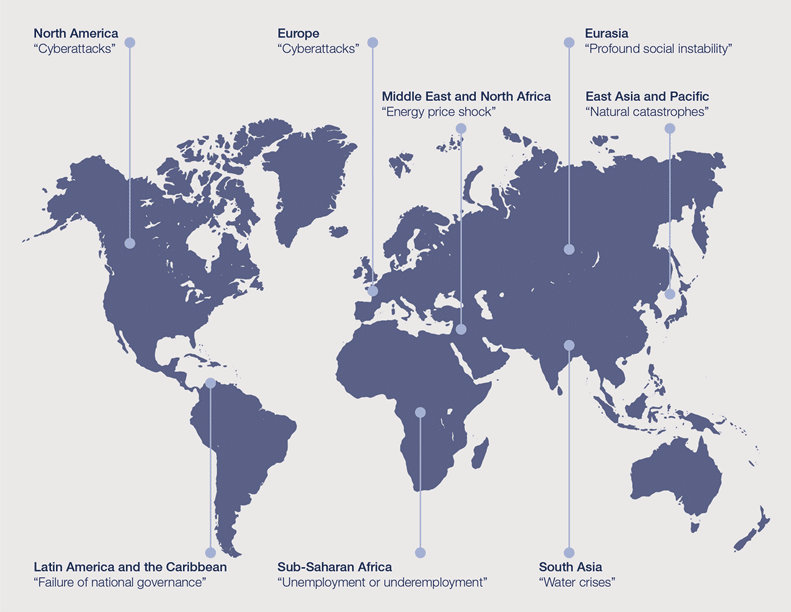

Grafik: World Economic Forum – Regional risks 2019 by region

Anyone involved in business planning must inevitably also deal with risks. As more and more companies are globally active or work with international production or supply companies, it is advisable to look at the geographical, economic, technological and humanitarian conditions and risks of the countries concerned. At the World Economic Forum 2020, The Global Risks Report 2020, a current hazard map, was presented. In the eyes of the almost 13,000 business leaders surveyed by the World Economic Forum this year, “financial crises” are the greatest risk to global business.

The key message of the study: The global economy is facing a “synchronized slowdown”. The last five years have been the warmest in a long time, and cyber attacks are expected to increase this year – all while citizens protest against political and economic conditions in their countries and express concerns about systems that exacerbate inequality. But the risks are not equally distributed everywhere, are partly interdependent and are best limited by immediate collective action to prevent the ruptures within the global community from becoming even greater.

And these are the 10 largest business risks in the world, but they have to be assessed quite differently from region to region, as the chart above shows.

- Financial risks

- Cyber attacks

- Unemployment

- Energy Price Shock

- Failure of national governments

- profound social instability

- Data fraud or theft

- Interstate conflicts

- Critical infrastructure failure

- Asset bubble

For example, the higher the degree of digitization and the larger the economy, the more lucrative cyber attacks can be, as in Europe and North America. By contrast, in the Middle East and North Africa, the “energy price shock” is still one of the main risks – with implications for other risk factors. Crude oil prices fell by 40% in Q4-2018, only to rise by almost 50% by April 2019. Moreover, as the recent attacks on oil plants have shown, the energy market is also threatened by geopolitical tensions. In a region where both companies and governments are so heavily dependent on oil, this kind of uncertainty and volatility makes planning very difficult.

Even as international relations become tense, the world is more interconnected and complex than ever before. This has two effects: First, that companies everywhere are increasingly exposed to global risks and second, that the traditional top-down approach is not sufficient to mitigate such risks.

The authors’ conciliatory conclusion: there is still scope for stakeholders to address these risks, but the window of opportunity is closing. Coordinated, multi-stakeholder action is needed quickly to mitigate the worst impacts and strengthen the resilience of regions and businesses.

However, what is not in the report are the methods and mechanisms for effective and efficient risk management, so that the risks can also be taken into account in the company’s own corporate planning.

You have got to know some methods in our step-by-step program or the CMA certification for Professionals. For all those who would like to go even deeper, we have in-depth specialist seminars and conferences.